Just how does the Laffer Curve relate to my hip replacement surgery?

In 1974, two of President Gerald Ford’s top White House advisers, Dick Cheney and Don Rumsfeld, had dinner with Wall Street Journal editorial writer Jude Wanniski and Arthur Laffer, former chief economist at the Office of Management and Budget. The United States was in the midst of a recession, and Laffer stated that the federal government’s 70 percent marginal tax rates were an economic toll booth slowing the US growth potential to a crawl.

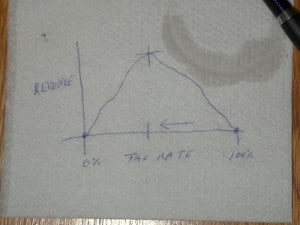

To illustrate his hypothesis, Laffer grabbed a pen and a cloth cocktail napkin and drew a chart showing that when tax rates get too high, they penalize work and investment and can actually lead to revenue losses for the government. Four years later, that napkin became immortalized as “the Laffer Curve.”

Initially the pain from my hip was little more than a ‘groin pull.’ My economic output was unphased. Slowly, gradually, consistently, my hip pain increased.

There came a time where the economic ‘tax burden’ of my hip pain exceeded almost everything else in my life. My physical output, my emotional output, my social output and my economic output diminished as the pain increased. The return on my efforts dwindled to almost zero (or has my mother-in-law says, “It now matches your IQ”).

Get your hip replaced, sooner, rather than later and watch your productivity improve dramatically.